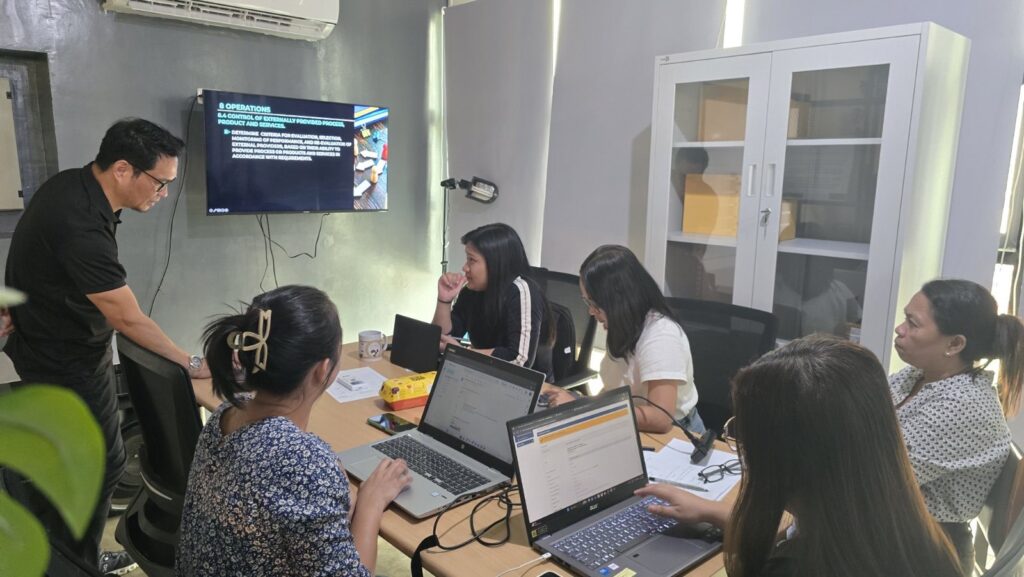

Every office has that moment when everyone suddenly starts behaving a little too well. Files are labeled perfectly, meetings start on time, and even the printers seem to cooperate. At Surepay Technologies Inc., that moment arrived the day the team decided to chase ISO 9001:2015. The atmosphere shifted from everyday routine to a lively countdown toward something bigger.

ISO 9001:2015 is the global playbook for quality management. It rewards teams that stay organized, think ahead, and deliver work with consistency. For a fintech company, this means sharper coordination, fewer mistakes, faster responses, and the kind of structure that helps a business grow without losing control.

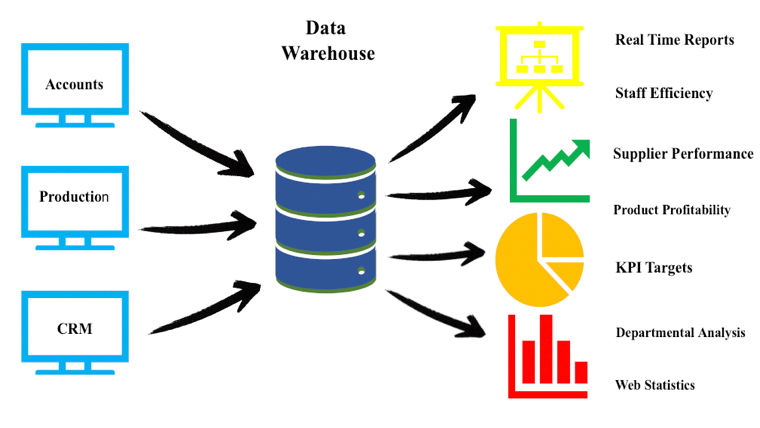

Surepay is embracing ISO because it wants a framework that supports real progress. Clearer processes make tasks easier to follow. Better documentation keeps everyone aligned. Stronger risk management helps the company stay steady as it expands its services and reaches more clients.

The journey is shaping a brighter outlook for Surepay. Quality becomes part of everyday habits. Confidence grows. Trust strengthens. The excitement at the beginning now narrows into a focused direction. Surepay is not only aiming for certification. It is building a future where smart systems and consistent excellence become the norm.