Electronic Fiscalization (E-Fiscalization) allows tax administrators to record, process, and store transactions digitally ensuring transparency, accuracy and compliance without complex procedures.

Global taxpayers manage business operations and meet tax obligations by documenting their business activities.

Documenting business transactions is a threshold issue between the

informal economy (undocumented) and the formal economy (documented) (Medina and Schneider 2018). Generally, a business creates documents relating to (1) obtaining and selling goods and services (purchase and sales invoices, cash register receipts), (2) inventory records, (3) delivery (transport documents), (4) receiving payments (financial records), and (5) accounting data.

Fiscalization is the vehicle that facilitates the documentation and online availability of business transaction data that, in turn, allows a tax administration to analyze those data to improve tax compliance (Alonso and others 2021). The general expectation is that fiscalization will lead to an increase in the level of tax compliance and a reduction of the tax gap by improving the transparency, access, richness, and accountability of data related to business activities.

Fiscalization is the vehicle that facilitates the documentation and online availability of business transaction data that, in turn, allows a tax administration to analyze those data to improve tax compliance (Alonso, 2021). The general expectation is that fiscalization will lead to an increase in the level of tax compliance and a reduction of the tax gap by improving the transparency, access, richness, and accountability of data related to business activities.

Fiscalization that is limited to just collecting and storing of digital documentation by the tax administration is unlikely to have a sustainable impact on taxpayer compliance behavior and is not able to address all tax non-compliance (Casey and Castro 2015). Committed noncompliant taxpayers are unlikely to respond unless the data are demonstrably used by the tax administration to identify and act on them.

In general terms, if a fiscalization system is implemented in local government treasury operations, it is aimed to provide the following:

- Tax Collection efficiency;

- Improves data collection across local government treasury;

- Engages consumers in the tax collection process;

- Provides more timely and richer data for analysis;

- Assists in identifying and assessing risks and developing corrective actions (facilitate and enforce) to address them;

- Enables errors to be detected and predicted so that taxpayers can be notified to make voluntary corrections;

- Provides data for use in enforcement action (debt collection, audit, sanctions, or investigation);

- Requires tax administrations to expand data storage, increase analytical capacity, and automate risk management and mitigation actions.

Effective data collection underpins the effectiveness of electronic fiscalization. Data collection commences with the creation of the documents (or e-documents) that taxpayers typically use to manage their business, such as sales invoices or fiscal cash register receipts, that are used for calculating and reporting tax obligations. Complete and accurate reporting of data to the tax administration relies on the timely capture of this documentation and data. Traditional tax reporting models rely on the periodic collection of aggregated business activity data without detail of individual transactions.

Fiscalization and digitalization in treasury operations provide tax administrations with real- time and more granular data on a taxpayer’s business transactions and on local treasury collections albeit under decentralize governance set-up. Data collection and consolidation of reports from local treasury happens immediately upon transaction or payment of taxes.

The local government treasury can adopt a centralized model or accreditation process of several systems. A centralized system or accreditation system process is deemed as a closed systems as the tax administration controls the issuance of receipts or electronic receipts. These can certainly reduce fraudulent collections or embezzlement of collected fees or taxes as data is reported on real-time. However, the efficiency greatly depends on the ability of the coverage of all tax collection units and issuance of a centralized electronic official receipts.

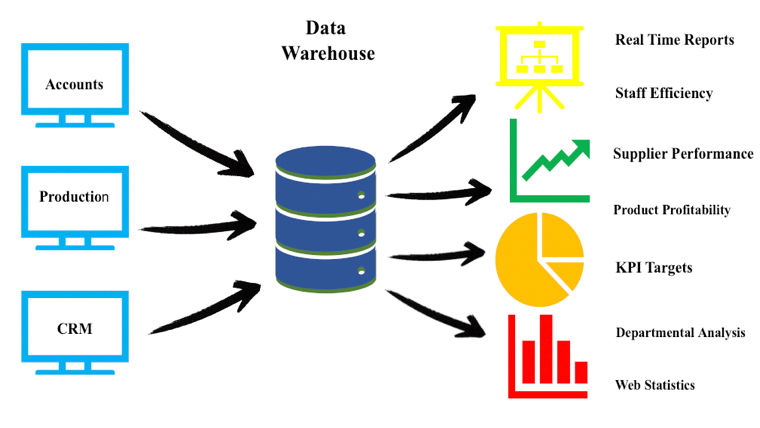

A data warehouse will be needed to hold the large volume of data collected through the fiscalization processes and third-party sources. A data warehouse is the repository for the collected data allowing access and analysis by the tax administration’s data analysts. If a tax administration does not have a data warehouse or an existing data warehouse will not have the capacity to store fiscalization data, the requirement to upgrade or purchase should be included in the fiscalization implementation information technology plan.

Leave a Reply